-

ROSSLARE EUROPORT TARGETS HEALTH & SAFETY WITH CAMERA TELEMATICS PARTNERSHIP - 2 days ago

-

Landmark Study Reveals Wearable Robotics Significantly Boost Safety and Efficiency in Industrial Environments - July 24, 2024

-

Visku Tackle The Retail Seasonality Challenge One Pallet At A Time - July 22, 2024

-

KAMMAC AND BERGEN LOGISTICS STRENGTHEN FASHION & LIFESTYLE SERVICES IN THE UK - July 19, 2024

-

TENTBOX EXTENDS PARTNERSHIP WITH ARROWXL TO SUPPORT INCREASING DEMAND - July 17, 2024

-

The Perfume Shop improves customer journeys while driving profitability in partnership with Scurri - July 17, 2024

-

ZEROMISSION SECURES £2.3M ($3M) INVESTMENT TO ACCELERATE ELECTRIC FLEETS - July 16, 2024

-

BCMPA CELEBRATES SUCCESS OF 2024 CONFERENCE - July 15, 2024

-

Best of the Best: Jungheinrich Celebrates Triple International Award Win - July 12, 2024

-

GOPLASTICPALLETS.COM CALLS ON NEW CHANCELLOR RACHEL REEVES TO CONSIDER PLASTIC PACKAGING TAX REFORM - July 10, 2024

Supply Chain Management Market Will Exceed $13 Billion in 2017, Up 11 Per Cent.

SCM Market to Reach $19 Billion by 2021 as SaaS Deployments Grow

Egham, UK, 22nd June, 2017 — The supply chain management (SCM) market will exceed $13 billion in total software revenue by the end of 2017, up 11 per cent from 2016. It is on pace to exceed $19 billion by 2021, as software as a service (SaaS) enables new revenue opportunities.

“Between 2017 and 2021, Gartner forecasts nearly $6 billion in total software revenue will be added to the SCM market,” said Chad Eschinger, managing vice president at Gartner. “Digitalisation is increasing demand for agility and forcing new business models, which is boosting spending in the SCM market.”

SCM providers are already differentiating themselves from competitors and driving revenue growth by incorporating new digital business technologies, such as mobile, machine learning, in-memory technologies, multienterprise visibility and the Internet of Things (IoT), into their offerings.

Mr Eschinger added that to remain competitive in this environment, end-user organisations are seeking to discover and exploit value in the huge amounts of data generated throughout an ever-extending network of businesses and connections that make up a modern supply chain.

Moreover, the move to SaaS delivery shifts costs from capital expenditure (capex) to operational expenditure (opex), which makes investment in SCM technology more attractive to small and midsize businesses (SMBs) and organisations in emerging markets, therefore expanding the addressable market and increasing overall spending.

The SCM market forecast is made up of three categories: supply chain planning (SCP), supply chain execution (SCE) and procurement. Adoption and associated revenue for SaaS are moving through the market at different rates, with procurement leading the move to cloud, and SCP trailing.

Overall, SaaS revenue growth is driven by a combination of factors: vendors moving to cloud-first or cloud-only deployment models, and end-user organisations becoming more comfortable with issues such as cloud security and appreciating the capabilities and innovation of leading-edge SaaS solutions.

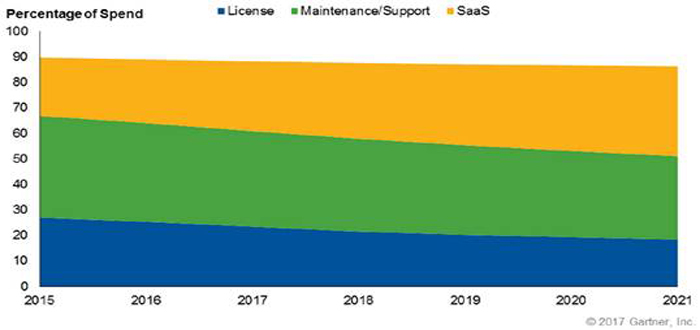

By 2021, SaaS deployments are forecast to account for more than 35 per cent of total SCM spending (see Figure 1). Sales of on-premises licenses will decline to less than 20 per cent of total spending. Hybrid SCM environments with coexisting cloud and on-premises applications are becoming more commonplace, with information hubs and supplier networks dominating the move to cloud.

Source: Gartner (June 2017)

“To help support next-generation supply chains and real-time business requirements, we expect consolidation of existing solutions into broader, multidomain suites, but also a continued stream of new point solutions that will support innovation, address specific needs and offer new value,” said Mr Eschinger.

“The growing impact of digital commerce will drive greater investment in supply chain analytics, and the lure of faster decision making and eradicating inefficiencies will drive investment in smart machines and IoT and the associated SCM software.”

Gartner clients can read more in the research note “Forecast Overview: Supply Chain Management, Worldwide, 2016 Update.”

To gain valuable external perspective on supply chain, visit SCM World, a cross-industry community of the world’s leading supply chain practitioners. Now a fundamental pillar of Gartner’s supply chain services, the community orchestrates and curates the most innovative strategies, insight, expertise and knowledge from across the SCM World community.

Gartner Supply Chain Executive Conference

Gartner analysts will provide additional analysis and information on supply chain trends at the Gartner Supply Chain Executive Conference taking place on 20-21 September in London. You can follow news and updates from the events on Twitter using #GartnerSCC.

Figure 1 below.. SCM Software Forecast by License, Maintenance/Support and SaaS Spend, 2015-2021. Source: Gartner (June 2017)